Explore expert insights, breakdowns, and guides designed to help you make smarter money decisions. Whether you’re curious about your take-home pay, tax changes, pensions, or UK salary trends — our latest posts offer clear, up-to-date advice tailored for UK professionals.

-

£24,000 Salary in London vs. Manchester: How Your Take-Home Pay Changes

Earning £24,000 per year is common in entry-level roles and service-based jobs across the UK. But where you live can drastically affect how far that money goes. In this article, we compare the monthly take-home pay and living costs between London and Manchester to help you understand the real value of a £24,000 salary in…

-

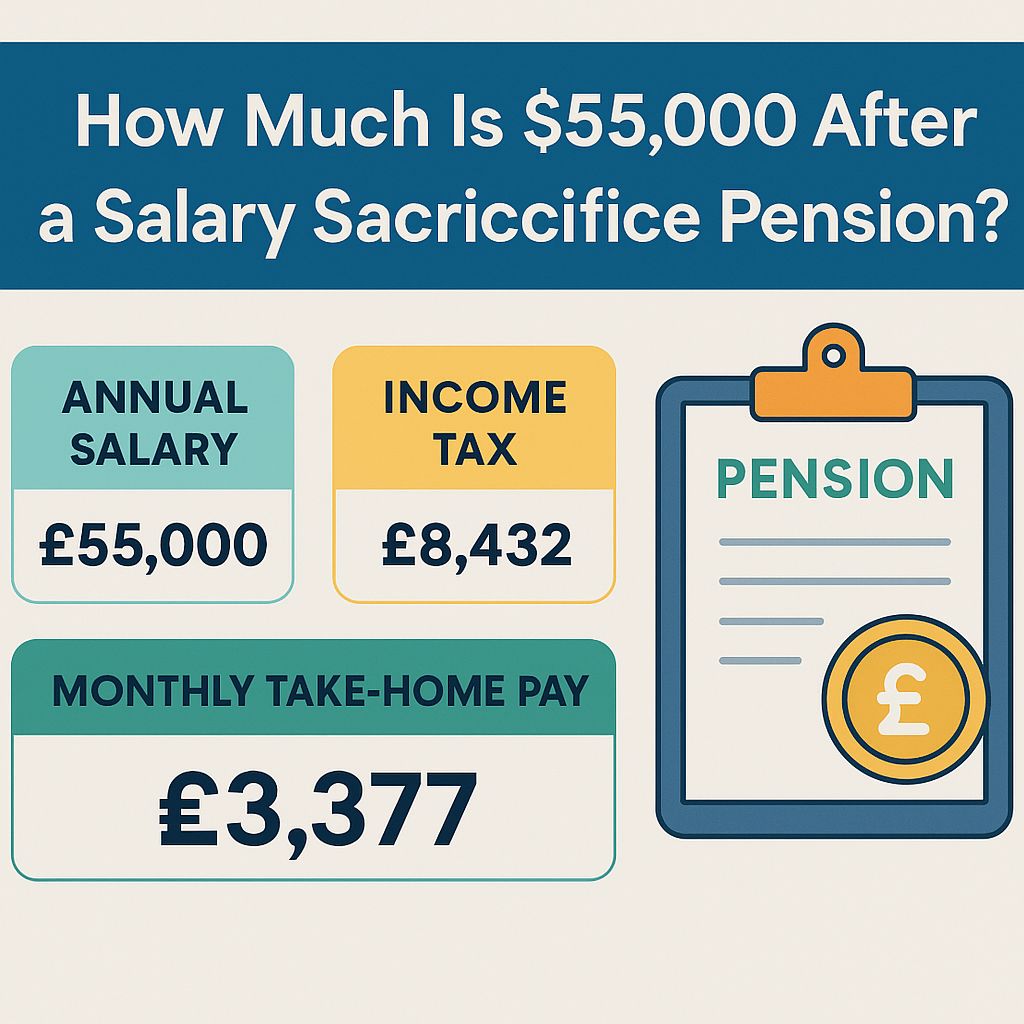

How Much Is £55,000 After Tax with a Salary Sacrifice Pension in the UK?

If you’re earning £55,000 a year, you’re in a solid financial position. But how you choose to contribute to your pension can make a significant difference to your take-home pay. One increasingly popular option is salary sacrifice, which allows you to lower your taxable income by redirecting part of your salary directly into your pension…

-

£70,000 Salary in the UK: What You Really Take Home in 2025

A £70,000 salary sounds impressive — and for good reason. It puts you well above the UK average and opens the door to a more comfortable lifestyle. But how much of that £70,000 actually makes it into your bank account each month? With income tax, National Insurance, student loans, and pension contributions all chipping away,…

-

£22,500 Salary in the UK: Monthly Take-Home Pay After NI and Tax

£22,500 Salary in the UK: Monthly Take-Home Pay After NI and Tax If you’re earning £22,500 per year in the UK, it’s important to understand how much of that actually ends up in your pocket each month. Between income tax and National Insurance, your take-home pay can be significantly lower than your gross salary. In…

-

£30,000 Salary in the UK: What’s Your Take-Home Pay After Pension and Student Loan?

Earning £30,000 per year is a common milestone for early-career professionals in the UK. But while the headline figure may seem straightforward, your actual take-home pay can look quite different once income tax, National Insurance, pension contributions, and student loan repayments are deducted. In this article, we break down exactly how much you can expect…

-

£28,000 Salary in the UK: Tax, National Insurance, and Take-Home Pay Explained

Earning a salary of £28,000 in the UK puts you slightly below the national average, but it still offers a comfortable income for many, especially outside of London. In this guide, we’ll break down exactly what you take home after tax, National Insurance (NI), and optional deductions like pensions or student loans. Gross vs Net…

-

How Does the 2025 National Insurance Increase Affect Your Payslip?

If you work in the UK, chances are you’ve noticed changes to your National Insurance (NI) contributions over the years. The 2025/26 tax year brings another shift in NI rates—and it’s worth understanding how that affects your take-home pay. What Changed in 2025? From April 2025: This means more of your earnings between those thresholds…

-

£45,000 Salary in the UK: What’s Your Monthly Take-Home Pay After Pension Contributions?

If you earn £45,000 per year in the UK, it’s worth understanding how pension contributions and taxes affect what you actually take home each month. With 2025 tax thresholds in place, let’s break it down. Gross Salary Overview This is before deductions for tax, National Insurance, or any pension contributions. Tax-Free Allowance and Deductions (2025/26)…

-

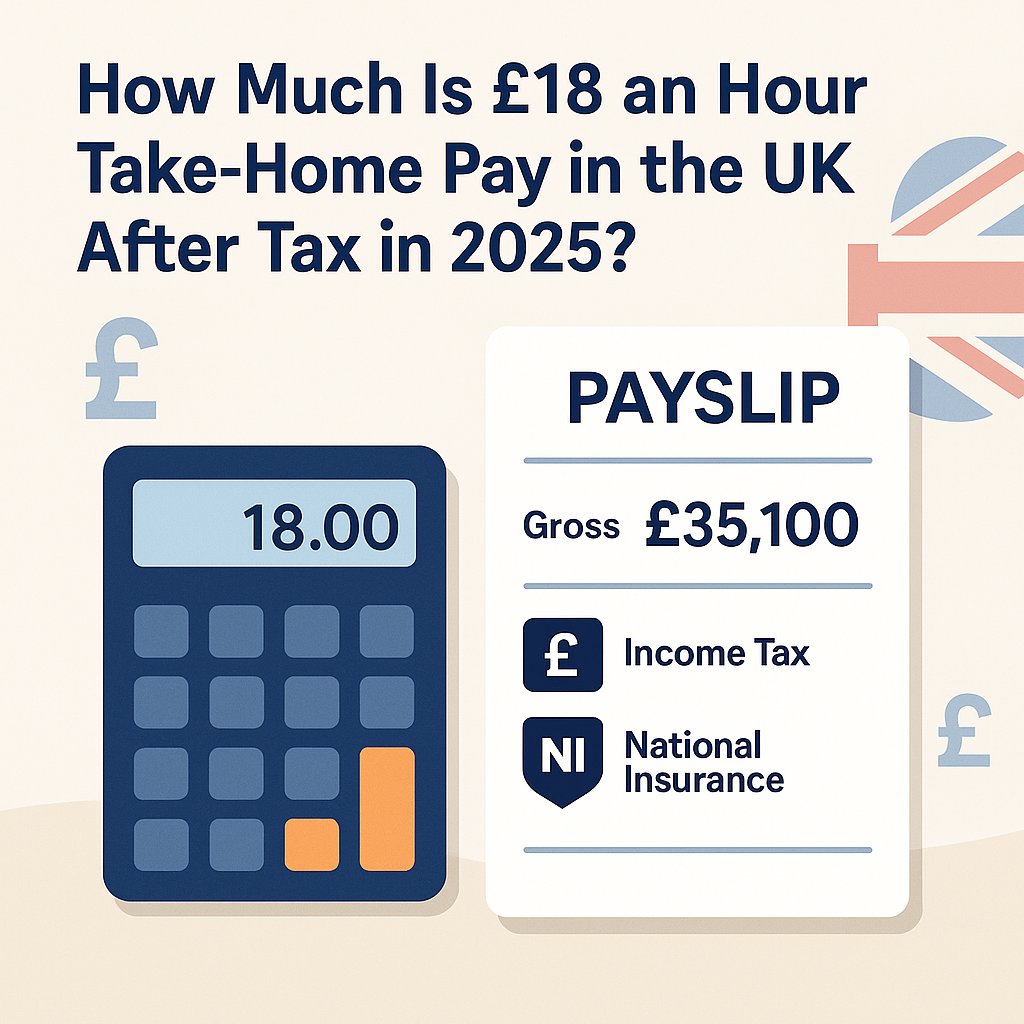

How Much Is £18 an Hour Take-Home Pay in the UK After Tax in 2025?

If you’re earning £18 per hour in the UK in 2025, it’s natural to wonder how much actually lands in your bank account after tax, National Insurance, and pension contributions. Let’s break it down. Gross Annual Salary If you work full-time at 37.5 hours per week, £18/hour translates to a gross annual salary of £35,100:…

-

£35,000 Salary in the UK (2025): How Much Tax Will You Pay?

If you’re earning £35,000 a year in the UK, you might be wondering what that really means for your take-home pay. Let’s break down exactly how much tax and National Insurance (NI) you’ll pay on a £35k salary in the 2025/26 tax year. Your Take-Home Pay on a £35,000 Salary On a gross annual salary…

-

What’s Your Daily Income from a £50,000 Salary in the UK?

Ever wondered how much you actually earn per day on a £50,000 salary in the UK? Whether you’re budgeting or comparing job offers, knowing your daily income can give you a clearer view of your financial landscape. Let’s break it down. Annual Salary vs Daily Take-Home Pay A £50,000 salary sounds substantial — but how…

-

Should You Opt Out of Your Pension in the UK? Here’s What You’ll Take Home Instead

Auto-enrolment into workplace pensions is standard in the UK, but what if you opt out? Would your payslip look better, or are you missing out on long-term benefits? In this guide, we break down what really happens to your take-home pay when you stop contributing to your pension — and whether it’s worth it. The…

-

How Much Do You Take Home on a £60K Salary with Tax Code 1257L?

If you’re earning a £60,000 annual salary and want to know exactly what you take home after tax, National Insurance (NI), and pension deductions — this guide is for you. Using the 1257L tax code (the UK default for 2025/26), let’s break it all down. Gross Salary vs Net Salary This means you only start…

-

What’s the Take-Home Pay on a £2,500 Monthly Salary in the UK?

If you earn £2,500 per month in the UK, you might be wondering what actually lands in your bank account after tax and deductions. While your gross salary is clear, the take-home amount can vary depending on your tax code, pension contributions, and other factors like student loans. Let’s break it down. Annual Equivalent of…

-

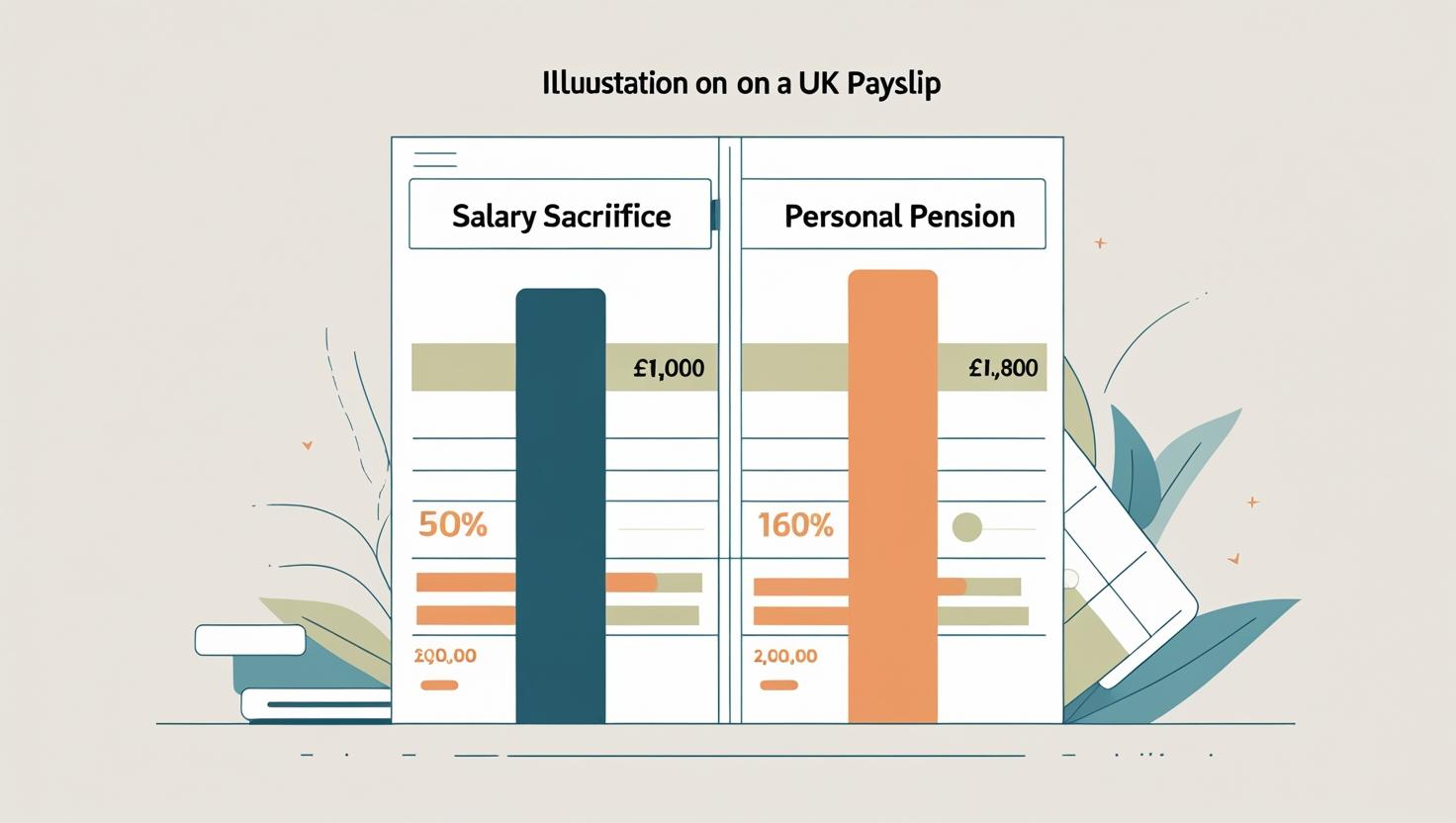

Salary Sacrifice vs. Personal Pension: What’s Better for Your UK Payslip?

When it comes to retirement planning in the UK, how you contribute to your pension can make a significant difference to your take-home pay. Two common methods are salary sacrifice and personal pension contributions, and they operate in very different ways. Let’s break them down and explore which might be better for you. 1. What…

-

Bonus Payments in the UK: How Much Tax Will You Actually Pay?

If you’ve ever received a bonus at work—or hope to—you’ve probably wondered: how much of it will actually end up in your bank account? In the UK, bonuses are taxed like regular income, but the impact can feel heavier than expected due to how they’re processed. Let’s unpack how bonuses are taxed in 2025/26, and…

-

£40,000 Salary in the UK: How Pension Contributions Affect Your Take-Home Pay

If you’re earning £40,000 a year in the UK, you might be wondering how different types of pension contributions impact your monthly take-home pay. With auto-enrolment now standard for most workers, and salary sacrifice and personal pension options on the table, it’s smart to understand the difference. Let’s break it down. 1. Auto-Enrolment Pensions (The…

-

How Much Is £15 an Hour Take-Home Pay in the UK After Tax in 2025?

If you’re earning £15 an hour, it’s only natural to wonder how much of that actually ends up in your pocket after tax, National Insurance (NI), and other deductions. In this guide, we’ll break down what £15 an hour looks like in terms of annual salary and monthly take-home pay based on the latest 2025/26…