Understanding How the Salary Calculator Works (2025 Edition)

Let’s walk through what powers the Salary Calculator, using the latest tax updates from April 2025. If you’re curious about how your take-home pay is calculated, this guide breaks it down for you—without jargon, but with all the important detail you need.

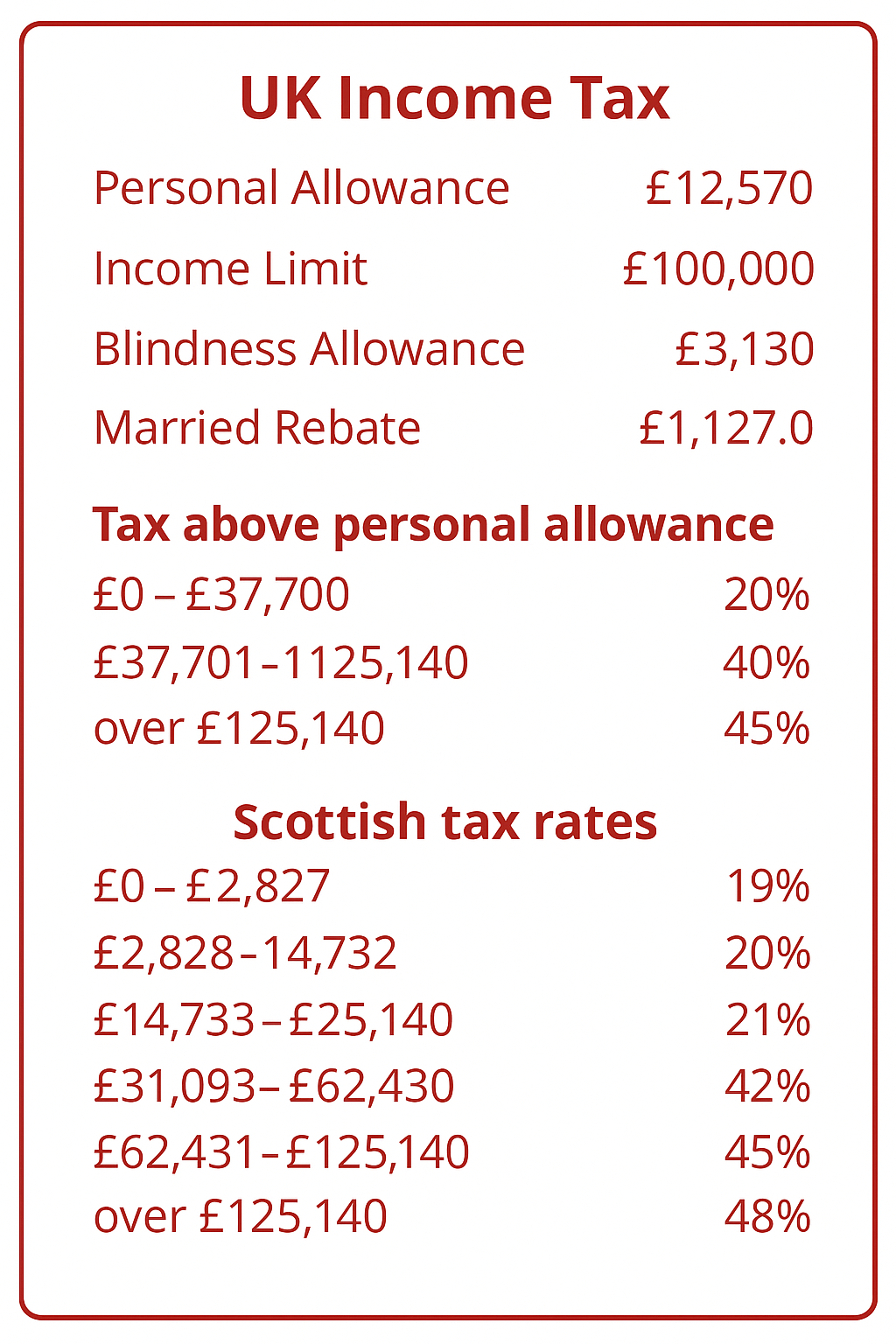

Income Tax Basics

In 2025, everyone in the UK gets a personal allowance of £12,570 before income tax kicks in. Earn over £100,000? Your personal allowance gradually shrinks until it disappears completely. Blind individuals get an additional £3,130 allowance, and people over 90 may receive a marriage rebate (up to £1,127, depending on income).

Tax Codes: What They Mean

Tax codes help HMRC decide how much tax-free income you’re entitled to. For example, code 1257L means you get the standard £12,570 allowance. If you have perks like private health insurance or a company car, HMRC might reduce your allowance, and that gets reflected in your tax code.

Quick guide to common codes:

- BR: 20% on all income

- D0: 40% on all income

- D1: 45% on all income

- K: You owe tax, so more is deducted

- NT: No tax

- S-prefix: You’re paying Scottish tax rates

National Insurance (NI)

For most people (NI Code A):

- Earnings up to £242/week: 0%

- £242–£967/week: 8%

- Above £967/week: 2%

Over State Pension Age? You don’t pay NI. The calculator assumes 0% NI if you tick “No NI”.

Student Loan Repayments

Your plan depends on where and when you studied:

- Plan 1 (pre-2012 England/Wales): 9% on income above £26,065

- Plan 2 (post-2012 England/Wales): 9% above £28,470

- Plan 4 (Scottish): 9% above £32,745

- Postgraduate: 6% above £21,000 (paid in addition to other plans)

You can repay multiple plans simultaneously. Childcare vouchers may reduce the income used for your repayment calculations.

Pensions: Types and Impacts

You can enter your pension contribution as a percentage or a fixed amount. Here’s how different schemes affect your salary:

- Auto-enrolment: Applied only to earnings between £6,240 and £50,270

- Employer/Occupational: Reduces taxable income (income tax impact only)

- Salary Sacrifice: Reduces income tax, NI, and student loan deductions

- Personal Pension: Tax is reclaimed separately (basic rate automatically; higher rates via tax return)

Annual limit for tax-free pension contributions: £60,000.

Childcare Vouchers

If your employer offers these, they can reduce the amount of income subject to tax and NI:

- Joined before 6 April 2011? You may get up to £2,916 tax-free.

- Joined after, and you pay 40% tax? Limit is £1,488.

- At 45% tax? Limit drops to £1,320.

These vouchers also reduce the income used for student loan repayments.

Bonuses

Bonuses are taxed like regular salary—the difference is they’re usually paid in one lump, so your tax and NI in that month may spike. The calculator shows a side-by-side comparison of normal and bonus months.

If your pension scheme deducts from bonuses, the calculator accounts for that if you tick the option.

Mortgage Calculator Note

We also offer a mortgage repayment calculator. It assumes monthly interest and doesn’t include fees or rate changes. It’s great for rough estimates but double-check with your lender for exact figures.

Final Note

All calculations are based on the 2025/26 tax year and updated budget figures. While The Salary Calculator gives a solid estimate of your take-home pay, always consult HMRC or a financial advisor for definitive advice.

Need to dive into a specific section? You can find more info on tax rates, pension thresholds, and student loan plans directly from HMRC or Gov.uk.