Earning £24,000 per year is common in entry-level roles and service-based jobs across the UK. But where you live can drastically affect how far that money goes. In this article, we compare the monthly take-home pay and living costs between London and Manchester to help you understand the real value of a £24,000 salary in each city.

UK Salary & Tax Breakdown Calculator

If you live in Scotland, income tax is calculated differently.

Rates and thresholds set by Scottish Government.

A common tax code is “1257L” meaning £12,570 tax-free allowance. Check your payslip, P60, or HMRC letter for your correct code.

• Plan 1: Started before September 2012 in England/Wales

• Plan 2: Started after September 2012 in England/Wales

• Plan 4: Scottish students

• Postgraduate Loan: For master’s/PhD courses

Your payslip or SLC account will confirm your plan.

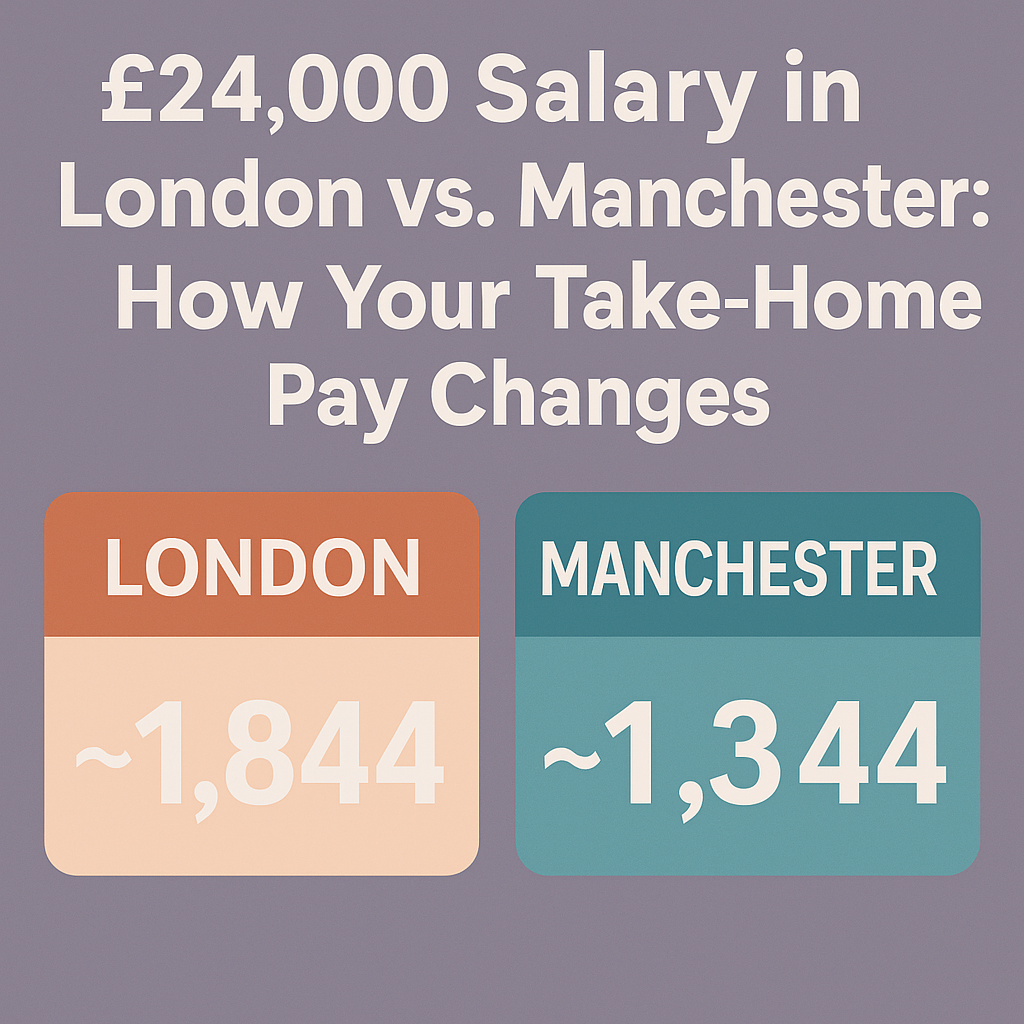

How Much Do You Take Home on £24,000?

Regardless of where you live, income tax and National Insurance (NI) are the same under UK law. Here’s a breakdown for the 2025/26 tax year:

| Description | Amount |

|---|---|

| Gross annual salary | £24,000 |

| Income tax | £1,286 |

| National Insurance | £588 |

| Net annual salary | £22,126 |

| Monthly take-home | ~£1,844 |

Assumes tax code 1257L, no student loan, and no pension deductions.

London vs. Manchester: Cost of Living Comparison

| Expense Category | London (est.) | Manchester (est.) |

|---|---|---|

| Rent (1-bed flat) | £1,600/month | £900/month |

| Travel (monthly pass) | £160 | £70 |

| Groceries | £300 | £250 |

| Council Tax | £140 | £130 |

| Total Essentials | ~£2,200 | ~£1,350 |

As you can see, your £1,844 take-home pay doesn’t stretch far in London — you’d be running a deficit unless you share housing or have additional income. In Manchester, however, you’d still have around £500+ left each month after basic costs.

Can You Live on £24K in London?

It’s possible, but tight. Most people on £24,000 in London live in shared flats, commute via public transport, and budget very carefully. You may also qualify for Universal Credit or council tax support depending on your rent and circumstances.

What About Pension or Student Loan Deductions?

If you’re enrolled in a 5% pension scheme, your monthly take-home pay would drop to around £1,744. If you’re also repaying a Plan 2 student loan, you’d lose another ~£60/month, bringing your net pay closer to £1,684/month.

In Manchester, that’s still manageable. In London, it may be extremely tight without additional support or shared expenses.

Is £24,000 a Good Salary?

In many UK towns and cities, £24,000 is livable — especially if you avoid high rental costs. In London, it’s below the recommended minimum income standard for a single adult. If you’re just starting out or receiving training, it’s a common entry point — but most people look to increase their salary over time.

Final Thoughts

While £24,000 gets taxed the same no matter where you live, your real-world take-home value can vary wildly. In London, you may feel squeezed — but in Manchester, you’ll likely have more breathing room. That’s why location plays such a big role in budgeting, lifestyle, and career planning.

Curious how much you’d take home on a different salary? Try our UK Salary Calculator to compare income, tax, and NI instantly.

Check out: