If you’re earning £55,000 a year, you’re in a solid financial position. But how you choose to contribute to your pension can make a significant difference to your take-home pay. One increasingly popular option is salary sacrifice, which allows you to lower your taxable income by redirecting part of your salary directly into your pension — before tax and National Insurance deductions. So, how much do you actually take home after tax if you opt for salary sacrifice on a £55,000 salary?

UK Salary & Tax Breakdown Calculator

If you live in Scotland, income tax is calculated differently.

Rates and thresholds set by Scottish Government.

A common tax code is “1257L” meaning £12,570 tax-free allowance. Check your payslip, P60, or HMRC letter for your correct code.

• Plan 1: Started before September 2012 in England/Wales

• Plan 2: Started after September 2012 in England/Wales

• Plan 4: Scottish students

• Postgraduate Loan: For master’s/PhD courses

Your payslip or SLC account will confirm your plan.

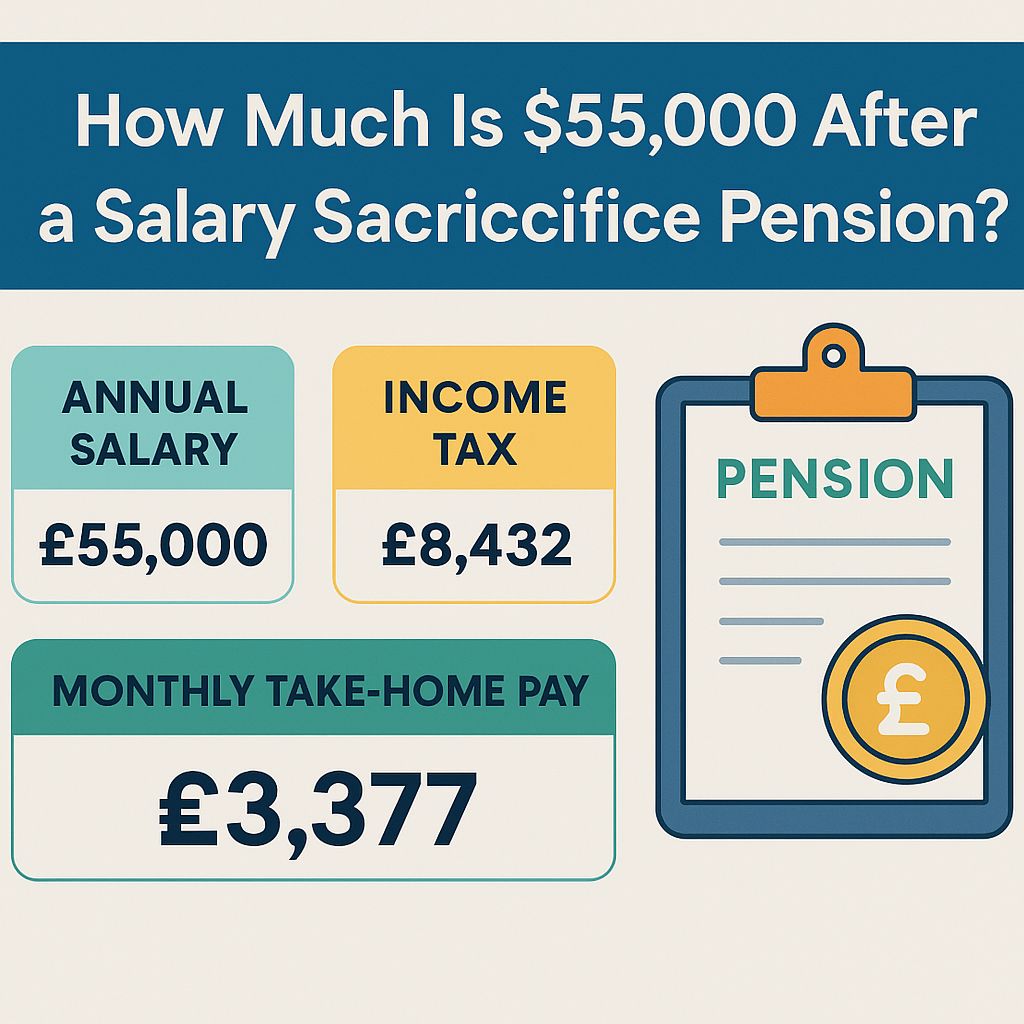

Summary: Take-Home Pay with and without Salary Sacrifice

| Scenario | Monthly Take-Home Pay |

|---|---|

| No pension contributions | ~£3,453 |

| 5% pension via regular method | ~£3,312 |

| 5% pension via salary sacrifice | ~£3,377 |

Figures based on 2025/26 tax year, tax code 1257L, and no student loan.

How Salary Sacrifice Works

Under a salary sacrifice arrangement, you agree to reduce your gross salary — in this case by 5% (£2,750) — and your employer contributes that amount directly to your pension. Because your official salary becomes £52,250, your Income Tax and National Insurance are calculated on that lower amount.

This results in:

- Less income tax paid

- Less NI paid (you save 8% on the sacrificed amount)

- More pension contributions without reducing your net pay as much as standard pension contributions would

Breakdown of a £55,000 Salary Without Pension

- Income tax: ~£8,432

- National Insurance: ~£3,115

- Monthly net: ~£3,453

This is your take-home pay with no pension contributions.

With 5% Pension via Standard Employee Contributions

- £2,750 contributed from post-tax salary

- Tax and NI remain based on the full £55,000

- Monthly net pay drops to ~£3,312

You contribute to your pension, but your tax and NI deductions stay the same.

With 5% Pension via Salary Sacrifice

- Your salary is reduced to £52,250

- Tax and NI are calculated on this reduced amount

- Income tax drops by around £550/year

- NI drops by ~£220/year

- Monthly net pay increases compared to standard method: ~£3,377

You save roughly £780/year in tax and NI — money that stays in your pocket while still contributing the same to your pension.

Should You Use Salary Sacrifice?

Pros:

- More efficient pension saving

- Higher take-home pay vs. normal pension contributions

- Can boost employer contributions in some cases

Cons:

- Lower official salary may impact mortgage affordability

- Affects some state benefits (e.g. maternity pay)

- You must opt in and get employer agreement

On a £55,000 salary, using salary sacrifice can boost your monthly income while still preparing for retirement. Instead of losing £140/month to a pension contribution the standard way, you could keep about £65 more per month in your pocket just by switching to salary sacrifice.

If you’re eligible, it’s one of the most tax-efficient ways to save for retirement — and it’s worth discussing with your employer or HR department.

Want to see your exact take-home pay with salary sacrifice and other deductions? Use our UK salary calculator to compare live figures based on your specific situation.

Check out:

- £70,000 Salary in the UK: What You Really Take Home in 2025

- 45,000 Salary in the UK

- What’s Your Daily Income from a £50,000 Salary in the UK?